Should you use a CPA?

Who are CPAs?

Chartered Professional Accountants (CPAs) are trained to have the technical and professional skills necessary to provide professional accounting services and offer valuable insights and advice to multinational corporations, small businesses, non-profits, government agencies, and individuals. They are respected for their leadership in public accounting, strategic thinking in corporate settings, and guidance in government accounting.

Value of a CPA

The Chartered Professional Accountants of British Columbia (CPABC) is the training, governing, and regulatory body for over 40,000 CPA members and 6,000 CPA candidates. CPABC carries out its primary mission to protect the public by enforcing the highest professional and ethical standards and contributing to the advancement of public policy. CPABC, through the CPA Act, fulfills its responsibility to regulate all matters, including competency, fitness and professional conduct, relating to the practice of accounting by CPA members, students, and registered firms.

CPAs are on the front lines of business in BC, and they see firsthand the issues that are affecting investment and the economy. CPAs advise multinational corporations, small businesses, not-for-profits, government agencies, and countless individuals. They are highly regarded for their leadership in the field of public accounting, their strategic insight in the boardrooms of top corporations, their guidance in government and public sector accounting and the responsibility and expertise in the application of tax, accounting and auditing standards.

Why work with CPAs?

CPAs are essential for financial reporting, auditing, and compliance. They help individuals and businesses navigate complex regulations, manage risks, and make informed decisions. CPAs and other professional service providers including financial advisors, lawyers, and notaries often team up to help clients with financial and legal matters. The synergies between what a CPA and a professional service provider offer to their clients make them a great combination to give clients the full service they require.

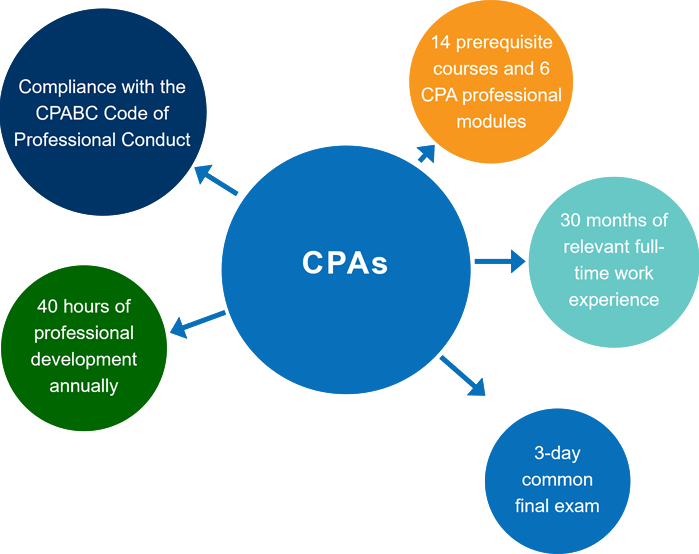

Only CPAs can call themselves professional accountants and are members of a regulated profession. Under the CPA legislation they are required to meet and maintain strict principles, including integrity and due care; objectivity; professional competence; confidentiality; and professional and ethical behaviour. Each CPA firm must carry professional liability insurance. As regulated professionals, in the unlikely event that an issue arises, there is a clear path to resolution.

While anyone can call themselves an “accountant” in BC, non-CPAs are not regulated. They don’t have the same consistent standards for education, experience, ethics, and ongoing professional development. Non-CPAs are also not required to carry insurance. Given the lack of regulation, if issues arise with their work, there is no clear path to resolution for those who use their services.

CPAs vs non-CPAs

What services are restricted to CPAs?

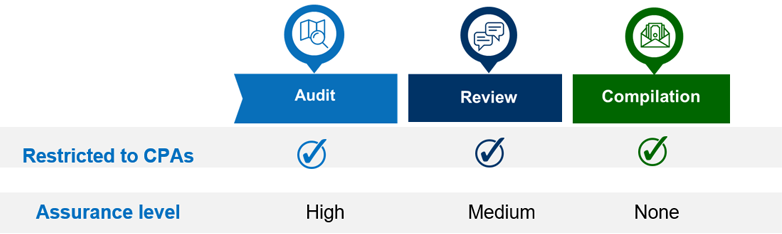

CPAs who provide services to the public must hold a public practice license. Some of the commonly known services include audits, reviews, compilations, tax advisory and compliance (T1, T2, T3), and statutory filings. These services are often tied to financial and legal services performed by other professionals. Only CPAs can provide audit, review, and compilation engagement services, which provide different levels of assurance to users of financial information. As such, their usage is often determined by law or regulation, or by an entity’s board or management.

Public Practice and Licensing

Every CPA who holds a public practice license must be attached to a registered CPA firm in BC. The registration of such a CPA firm also comes with specific requirements related to ownership, legal structure, and a mandatory required level of professional liability insurance. Adding to the value of a CPA, you can rest assured that CPA firms are periodically reviewed by CPABC to assess their ongoing compliance with professional standards.

Only CPAs can provide audit, review, and compilation engagements services which provide different levels of assurance to users of financial information. As such, their usage is often determined by law or regulation, or by an entity’s board or management.

Tax Services

Tax services are not restricted to CPAs, however, as mentioned, CPAs who provide tax advisory and compliance services (T1, T2, T3) and other statutory filing services are required to hold a license and they are required to maintain their professional competence, which is not a requirement of non-CPAs.

CPA Member and CPA Firm Directory

All CPABC members and CPABC registered firms are listed in a public directory so one can always check to make sure they are working with a CPA.

Additional Information and Resources

CPABC has prepared a collection of public resources to help you in your relationship with your CPA.

The one-page PDF information circular, containing the information above, is available for CPABC members to assist them in educating the public about the value of using a CPA.

Let’s Get in Touch!

Should you have any additional questions you can always reach out to our Advisory Services team.