Deadline for the Three-Year Cycle is December 31, 2017

From CPABC’s Continuing Professional Development Department

The success of the chartered professional accounting profession relies on the profession’s reputation for upholding the highest ethical standards. Maintaining public trust is critical to the sustainability of the profession.

Having a high standard of business ethics is good business practice. Organizations that demonstrate ethical behaviour and corporate social responsibility have a better chance of succeeding because they attract and retain loyal customers, employees, and investors.

Management is responsible for leading an ethical culture by establishing appropriate policies, exhibiting ethical behaviour, and supporting staff at all levels with their decision-making.

Why have a CPD requirement for business ethics?

CPAs will be confronted with challenging ethical situations throughout their professional careers, and the pressures of meeting competing objectives can make ethical decision-making difficult.

A continuing professional development (CPD) business ethics requirement supports members. CPD provides an opportunity for members to discuss with professional peers the challenges, complexities, and risks faced when ethical dilemmas arise. This learning is such a valuable activity—both from the perspective of members and from the perspective of the public they serve—that many accounting bodies around the globe have adopted a mandatory ethics PD requirement.

What is business ethics CPD?

Business ethics CPD is learning that specifically addresses business ethics matters that are relevant and appropriate to the member. Business ethics CPD can cover a wide range of topics related to ethics and ethical decision-making.

Examples of business ethics-related topics include, but are not limited to, the following:

- CPABC regulatory updates covering the Chartered Professional Accountants Act, bylaws, bylaw regulations, and the Code of Professional Conduct

- Regulatory updates relevant and appropriate to the member’s role and/or industry

- Professional conduct

- Doing the right thing

- Ethical decision-making, approaches, thinking, and case studies

- Honesty in business practice

- Corporate codes of conduct

- Ethical business culture

- Independence

- Conflict of interest

- Corporate social responsibility

- Bribery and corruption

- Money laundering

- Reputation and risk

- Whistle-blowing

What are CPABC’s business ethics CPD requirements?

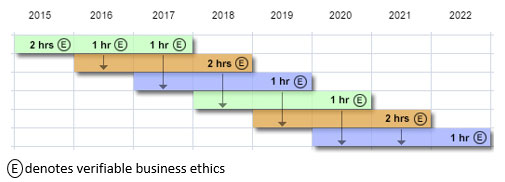

Every member must complete a minimum of four verifiable business ethics CPD hours as part of their 60-verifiable-hour requirement in each three-year rolling cycle[1]. For many CPAs, the first deadline to meet this requirement is December 31, 2017, for the three-year CPD rolling cycle of 2015-2017 (see table below).

The four hours of business ethics do not have to be obtained in a single program, and can be accumulated through ethics components from any number of seminars or courses over the rolling three-year cycle. The requirement can be fulfilled in a number of ways, through CPA programs or other structured learning sources, including in the workplace.

| CPA, CGA |

|

|---|---|

| CPA, CA |

|

| CPA, CMA |

|

Illustration #1

If a member (regardless of legacy designation) obtained all four hours of business ethics in 2015, they must complete the ethics requirement again by no later than 2018, and so on. The requirement is applied on a three-year rolling basis. See example:

Illustration #2

If a member (regardless of legacy designation) accumulates the four hours of business ethics over multiple years in the three-year cycle of 2015-2017, they should remember that any business ethics completed in 2015 will “fall off the table” in 2018. In 2018, they will need to ensure that they have accumulated four business ethics hours in the three-year cycle of 2016-2018, and so on.

Where to find ethics courses

Business ethics is becoming an increasingly hot topic, and many course providers are offering programs and seminars on ethics-related matters.

Although members can fulfil their ethics CPD requirement through any course provider, CPA Canada and CPABC are committed to supporting members with professional development related to business ethics topics through seminars and online learning opportunities.

In January 2017, CPABC’s PD team will be unveiling an updated four-hour seminar entitled “Ethical Principles and the Accounting Profession – CPABC Code Decoded.” An online version of this course will also be available from CPA Canada. The CPABC PD program also features a number of seminars with ethics content built into the syllabuses. If a course has ethics-related content, you’ll see a note to that effect in the course description.

For a current listing of courses offered through CPABC’s PD Program, visit the PD website at pd.bccpa.ca.

What members have said about ethics learning

“Ethics is an important component of what we do.”

“I’ve taken ethics courses before, but not CPA-focused ethics courses, and [the content in this seminar] was an excellent reminder.”

“The case discussions [in the Ethics 24/7 seminar] were really good for participants to work through the decision-making framework for complex situations.”

“I enjoyed the discussion of personal experiences and sharing examples of possible ethical dilemmas.”

Need help?

If you have an ethical dilemma and would like to speak to a professional standards adviser in CPABC’s member services department to receive confidential guidance, contact Stella Leung, CPA, CA, at 604-488-2609, or Brigitte Ilk, CPA, CGA, at 604-629-8363. Both can also be reached using our toll-free number at 1-800-663-2677.

For questions about the business ethics CPD requirement, please email us at cpd@bccpa.ca.

Footnotes

- A reminder: Effective 2017, all CPAs will be subject to a three-year rolling CPD cycle on a continual basis. In each three-year rolling cycle, every member must complete at least 120 hours of CPD, at least 60 of which must be verifiable.

Rate this Entry

Current rating: 0 yes votes, 0 no votes