Whether sustainability reporting will actually improve sustainability performance is not just a question of frequent discussion among academics—it’s also top of mind for accounting professionals. And it’s a timely and important question given the movement towards sustainability disclosure regulation taking place around the world.

Take, for example, the European Union’s mandatory Corporate Sustainability Reporting Directive (CSRD), which came into effect for some companies in 2024. What makes the CSRD notable is that it is the first mandatory reporting requirement that affects a wide range of companies, and not only in the European Union. Canadian companies who do considerable business in the EU may also have to report in the next few years, depending on their employee count, assets, and turnover. By requiring greater transparency in sustainability reporting, the intent of the CSRD is to motivate companies to lessen their negative environmental and social impacts.

Numerous academic studies have been published on this topic over the past 30 years, and while earlier studies reached different conclusions about the relationship between sustainability reporting and performance improvement, most of the studies conducted after companies gained experience in designing their sustainability performance and reporting systems showed these two metrics moving in the same direction. Additionally, the later research did identify variables that play an important role in determining whether an organization will meet its sustainability performance improvement objectives through enhanced reporting.

Kitinut/iStock/Getty Images

This article will describe these variables and set out a sustainability management and reporting system that is more likely to bring about real change for organizations by reducing some of the complexity.

Standards are an important variable

Standards provide useful guidance not only in the reporting process but also in designing a sustainability management and reporting system that is more likely to improve performance.

The first global reporting guidelines were issued by the Global Reporting Initiative (GRI) in 2000, and they identified stakeholder engagement as the initial step in developing a sustainability management and reporting system. Most—but not all—companies that were serious about performance and reporting improvement chose to follow these guidelines.

In 2016, GRI turned these guidelines into the first set of global standards, called the “GRI Standards.” The GRI Standards emphasize a broader notion of materiality—referred to as double materiality—comprising both activities that affect financial results and activities that affect external parties. Notably, through its own stakeholder engagement, the GRI created industry-specific supplements that recognize the uniqueness of diverse industries; but while these supplements are useful, the GRI still recommends that organizations engage with their stakeholders individually to determine materiality.

Other similar standards followed, albeit with slightly different scopes. For example, the standards issued by the Task Force on Climate-Related Financial Disclosures (TCFD) narrowed to metrics only for climate change, and those issued by the Sustainability Accounting Standards Board (SASB) were targeted to publicly held companies only (primarily with their shareholders in mind).

The latest sets of reporting standards include those issued by the International Sustainability Standards Board (ISSB) under the IFRS Foundation. Although most standards are similar, the ISSB standards seek to reduce confusion by consolidating previous frameworks and guidelines developed by other standard-setting bodies, such as the TCFD, the International Integrated Reporting Council, and the SASB. The ISSB standards lay out the first step in creating a sustainability system, which is deciding which aspects of sustainability are most material and pose the greatest risks. Per the ISSB, these aspects should then be included in the firm’s performance initiatives and reports.

To date, most companies committed to performance and reporting improvement have tried to show that they were meeting the requirements of multiple standards. Hopefully, the ISSB standards will streamline the process and make it easier for companies.

Making connections

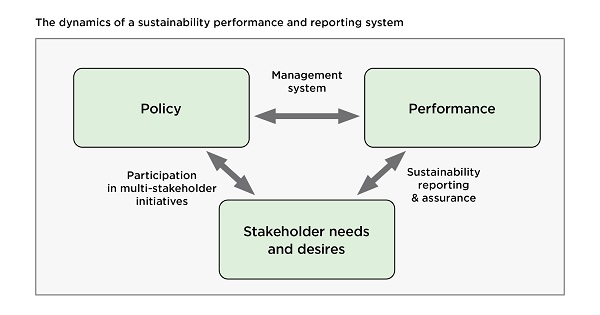

Now let’s discuss other key variables using an illustration that depicts the symbiotic relationships between stakeholders, policy, and performance.

We adapted this illustration from the work of Thomas Zenisek, who conceptualized this framework of corporate social responsibility in 1979, while a professor of organizational behaviour at the University of Calgary.1 Zenisek emphasized the necessity for strong reciprocal linkages between an organization’s policy statements, actual performance, and stakeholders to ensure corporate social responsibility. We updated the illustration to more clearly define the linkages and incorporate what we’ve learned from subsequent research about the variables that will support performance improvement through credible sustainability reporting. Put simply, the message is that there must be strong connections between what an organization promises, what it delivers, and what society expects. But let’s look a bit deeper at each section of the illustration.

Policy

Improving sustainability should not be a disorganized or pick-and-choose set of activities. Organizations need a good plan, and it should start with a sustainability policy. This policy should include a definition of sustainability along with a detailed strategy and related objectives comprising economic, environmental, and social factors.2 In addition, the policy should map out how these related objectives will be interconnected to produce sustainable outputs and outcomes.

Most reporting standards indicate that these policies should be informed through engagement with stakeholders—both internal, such as employees and managers, and external, such as community members, investors, creditors, suppliers, and others affected by the organization’s operations. The organization should identify aspects that are of high importance to each set of stakeholders and have a high impact on the organization itself.

The aspects that are determined as high on both descriptors will set the stage for both performance and reporting and should be confirmed through an internal review by the board of directors and the top management team. In addition, the report itself should provide information on the stakeholder engagement process. At least two standard setters—the aforementioned GRI and AccountAbility, a consultancy firm well known for setting standards for sustainability reporting and assurance, particularly in Europe—provide good guidance on how to undertake stakeholder engagement and on the steps that should be taken and reported to ensure the process is relevant and credible.

Some sustainability practitioners may argue that stakeholder engagement is unnecessary given that certain reporting standards, such as those issued by the ISSB and its related standard-setter, the SASB, have already identified specific disclosure topics by industry. However, it’s important to remember that organizations—even those in the same industry—operate in different contexts and have stakeholders with diverse and unique needs.

Additionally, the SASB Standards focus on the financially oriented disclosures needed by investors, analysts, and other market participants, and do not necessarily recommend that individual organizations engage with broader sets of stakeholders. Adhering to this narrower scope might make the process of engagement more efficient, but when one organization operates in several different industries or communities, with different customers and supply chains, broader engagement helps to customize performance and reporting to unique stakeholder needs, potentially making it more effective.

An example of a multi-stakeholder engagement model can be found on Unilever’s website at unilever.com. Now considered a leader in overall sustainability, Unilever is one of several companies that uses its reporting to target areas needing improvement. As evidence of the positive impact of this approach, Unilever received a sustainable supply chain award at the World Sustainability Congress 2024 in Amsterdam.

It’s important to note, however, that the sustainability reporting process is less about achieving a static goal (although this is also important) and more about continuous improvement, accountability, and engagement. It is a process that is just as much about identifying weaknesses in performance and stating how they will be shored up as it is about communicating achievements and successes.

Imagine each of the following stakeholder engagement disclosures in a sustainability report:

- “We engage with our community stakeholders.”

- “Our sustainability reporting is based on the actions identified as important by our suppliers, customers, regulators, and community stakeholders during individual consultation sessions. These actions were also reviewed by our upper management team. In our reporting, we explain our progress in addressing the materiality of these actions, and we identify the challenges we face along the way.”

Which do you think would instil more confidence in the reader? The second set of statements indicates that the organization has identified the aspects of sustainability that are important to its various stakeholders and/or those that might create risk to the organization if ignored. Our message here is that sustainability reporting must be sincere, detailed, and in line with both internal and external stakeholder needs if the report is to be useful in determining an organization’s performance and reporting direction.

Performance

The next stage of the illustration shows that these policy statements must link to actual performance through a strong management system. Furthermore, actual performance must continue to inform the policy statements so that these statements can be continuously updated to accurately represent the changing context in which the organization operates. Performance does not just “happen”; good processes, procedures, and control mechanisms are needed to ensure that the organization’s performance targets are achieved.

The appropriate people must be tasked with fulfilling objectives and reaching targets, and their achievements should receive proper recognition. Personnel should be adequately trained and have appropriate resources (e.g., sufficient budgets) to better ensure that organizational objectives are accomplished. In summary, it is essential that employees know what is important to the organization, share the same values through education and training, are committed to the organization’s goals, and have the capacity to carry out their work.

Performance should be reported to the leadership team periodically, with preference given to the CFO for all environmental, social, and financial metrics. The CFO would then report performance to the board of directors, which should have a committee responsible for ensuring that policy is turned into action. Some organizations also have chief sustainability officers (CSOs) who may report to the CFO or CEO. In these organizations, the CSO frequently plays a key role in integrating sustainability into corporate strategy and leads stakeholder engagement and discussions about potential trade-offs between the needs of different stakeholder groups.

Additionally, the governing board members should have expertise in sustainability and be diversified in terms of gender, age, and independence—and if the organization’s operations are international, there should also be international representation. This board should be responsible for reviewing the performance report and providing thoughtful feedback to management regarding progress.

After this review process, the organization will be ready to provide a report to stakeholders communicating its progress on the sustainability aspects earlier defined as material. This report will then serve not only as a reliable and transparent source of information for its external stakeholders, but also as a tool for internal improvement.

Prior to publication, there are several steps the organization can take to ensure the reliability and relevancy of its reporting. One is ensuring that the report provides a balanced discussion of both successes and challenges—without this balance, the report will not provide good direction for performance improvement. When personnel are so close to their own reporting, they may not realize that a report lacks this balance. For this reason, it’s important to have others who are independent from the report provide guidance for improvement before the report’s publication and distribution.

First in line should be the internal auditor team, which can review metrics and ask critical questions about how the organization’s activities improved a metric. This process will ensure the metric’s accuracy and reliability. An advisory board whose membership is representative of the organization’s internal and external stakeholders can also help strengthen the integrity of the report and ensure that it accurately reflects performance. Advisory board members would read the report before publication to provide feedback for improvement. Additionally, if the organization can afford third-party verification, it could enlist an assurance provider to advise on how the organization’s systems could be improved or disclosure could be made more relevant to help with performance improvement.

Stakeholders

The final stage of the illustration is about the report being made available to the organization’s stakeholders. However, the process doesn’t stop here—as the two-way arrows suggest, the organization should invite feedback to understand how stakeholders perceive its performance and identify where improvement may be necessary. To this end, the organization should designate a point person to serve as the contact for stakeholder feedback and name this person in its report. Even better—and in keeping with responsibility accounting—if a manager’s name can be added to each aspect or section of the report as the contact for feedback, this will emphasize the seriousness with which the organization is taking performance improvement. The organization may also want to create a stakeholder advisory panel, as these can be valuable assets for reporting and performance improvement.

All feedback should be considered as to how it might affect a change in the organization’s direction for the coming years. Does the policy need updating? Are the objectives still focused on the most material aspects of operations? Are targets sufficiently rigorous? By staying engaged with its stakeholders and continually revisiting its system to ensure that procedures and processes are working properly, an organization will increase the probability of its sustainability report serving as a strong, internally driving document that helps improve performance.

A process of continual improvement

Ultimately, there is no such thing as an ideal sustainability report. The goal with reporting on material sustainability issues should not be to produce a document with full marks on these issues and then call it a day. In fact, if an organization were to achieve all of its sustainability objectives in a given year, it might suggest that these objectives were not sufficiently rigorous. Instead, the goal should be to continue making improvements on the aspects of greatest importance to the organization and its various stakeholders and use the sustainability report as a critical and living document in this process.

CPABC President and CEO Lori Mathison, FCPA, FCGA, LLB, recently sat down with Zahra Kolia, CPA, CA (SA), vice-president of finance at Copperleaf Technologies, to discuss how ESG-related initiatives are driving positive change in the tech sector. This interview was part of the Coffee Chats with CPABC podcast series, and you’ll find a companion article in the CPABC Newsroom.

Irene M. Herremans, PhD, is a professor at the University of Calgary, both in the Haskayne School of Business and in the Sustainable Energy Development Master of Science program. She is also an award-winning researcher, a CPA, CMA, in Alberta, and a CPA (Wisconsin).

Douglas Stuart, CPA, CA, is an assistant teaching professor at the University of Victoria’s Gustavson School of Business, a CPABC faculty ambassador, and the author and co-author of several sustainability-themed articles for CPABC in Focus. He also holds the Fundamentals of Sustainability Accounting (FSA) credential.

This article was originally published in the January/February 2025 issue of CPABC in Focus.

Footnotes

1 Thomas J. Zenisek, “Corporate Social Responsibility: A Conceptualization Based on Organizational Literature,” Academy of Management Review, 4(3), 1979 (359-368).

2 Though sometimes used interchangeably, the terms sustainability and ESG (environmental, social, and governance) are not the same. Sustainability refers to an organization’s economic, environmental, and social impacts, while ESG focuses on how the organization manages the risks and opportunities associated with sustainability. Governance is not an outcome of sustainability—rather it is a means to increase the probability of reaching the desired outcomes of sustainability’s economic, environmental, and social dimensions.