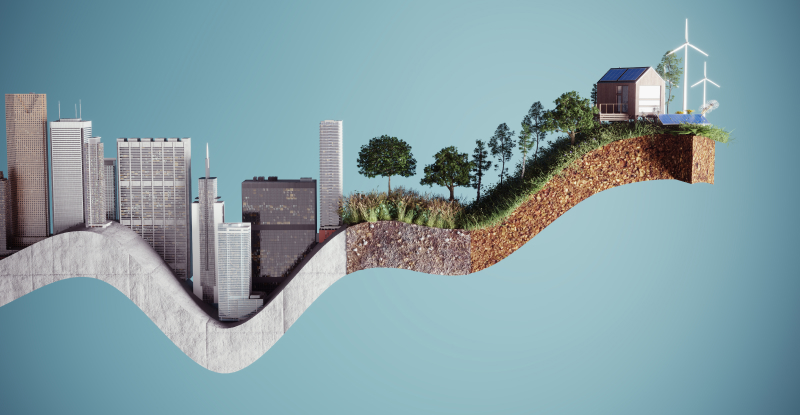

Meeting present and future needs

Sustainability is defined as meeting the needs of the present without compromising the ability of future generations to meet their own needs. It encompasses climate change, biodiversity, social movements, inequality, and health and wellness. It may be called “ESG,” “responsible investing,” or “sustainable investing.” These labels refer to the incorporation of environmental, social, and governance (ESG) considerations into investors’ portfolio decisions.

Creation and role of the ISSB

The IFRS Foundation created the International Sustainability Standards Board (ISSB) in November 2021 with a mandate to establish uniform sustainability-related disclosure standards that provide investors with information about ESG risks and opportunities. Business leaders and accounting professionals must respond and adapt, incorporating sustainability into their strategic planning, operations, supply chains, and reporting across all lines of business and geographical segments.

The ISSB announcement coincided with the United Nations (UN) 26th Conference of the Parties (COP26), the annual meeting of the signatories to the UN Framework Convention on Climate Change. It follows decades of efforts by governments, NGOs, and businesses to push sustainability, dating back to the 1987 UN Report “Our Common Future.” Sustainability – previously called corporate social responsibility (CSR) – gained momentum with the 1992 Earth Summit, the 1997 Kyoto Protocol, and the 2000 Millennium Summit that created the UN Sustainable Development Goals. At COP21 in 2015, governments committed to revised targets for the reduction of greenhouse gas emissions under the Paris Agreement. The COVID-19 pandemic, #BlackLivesMatter, and #MeToo movements have also fueled this movement.

The ISSB is a merger of two non-profits, the Climate Disclosure Standards Board (founded in 2007 and run by CDP) and the Value Reporting Foundation (VRF). The VRF was created in 2021 from the merger of two non-profits, the International Integrated Reporting Council (founded 2010) and Sustainability Accounting Standards Board (founded 2011). The consolidation of these reporting entities under the ISSB reflects the demands from investors for a comprehensive global baseline of high-quality sustainability disclosure standards.

The market’s role

The sustainability agenda is also market driven. Institutional investors are pushing standard setters, governments, regulators, and businesses. These investors are coordinated by UN Principles for Responsible Investing (PRI), the Taskforce for Climate Related Disclosures (TCFD), and many consortiums that have made Net Zero 2050 pledges. Asset managers and banks are coordinating engagements, demanding disclosure, sponsoring votes at annual general meetings, and pressuring companies directly and indirectly. Across verticals, leading firms will be rewarded, and laggards will be punished by markets, banks, rating agencies, and other stakeholders.

With rapid change ahead, it’s time to get on board

The ISSB timetable is rapid relative to past accounting changes. The ambition is to complete the necessary institutional and technical standard-setting work to establish the core elements of the global baseline by the end of 2022.1 At its October 2022 meeting, the ISSB voted to proceed with the proposed requirement for an entity to disclose its absolute greenhouse gas emissions (Scope 1, 2 and 3).2 This news coincided with the COP27 meetings in Sharm El Sheik, Egypt, where climate scientists announced the goal of limiting global warming to +1.5℃ was out of reach due to the accumulated carbon in the atmosphere.

Mandated sustainability reporting is a paradigm shift. It is changing how investors value companies through ESG integration. It is changing how senior executives run their businesses and communicate strategic objectives. It is changing how consumers, employees, communities, and other stakeholders view businesses. And it will dominate financial and accounting discussions for years to come. If you haven’t already, it’s time to get on board.

Michael R. King, PhD, CFA, is an associate professor and Lansdowne Chair in Finance at the Gustavson School of Business at the University of Victoria.

1 IFRS Foundation, “Path to global baseline: ISSB outlines actions required to deliver global baseline of sustainability disclosures”, May 18, 2022.

2 This proposal is contained in Exposure Draft IFRS S2 Climate-related Disclosures. The IFRS Foundation, “ISSB Update October 2022”, accessed Nov 11, 2022.