What is ESG and how does it tie into the Doughnut Economics model? In this podcast episode, Mia Maki, FCPA, FCMA, shares her insight with CPABC’s president and CEO, Lori Mathison, FCPA, FCGA, LLB. Part of our Coffee Chats with CPABC podcast series.

How a radical business model is changing the goal for business

Economic models work, until they don’t. They provide a useful way for decision-makers to better understand our world, predict the outcomes of actions, and guide policy, but eventually they fail to keep up with evolving events. Consider some major changes over the past 50 years. The oil shocks of the 1970s led to a new economic term—“stagflation”1 —and government and businesses adapted. After the 1980 inflationary rollercoaster, with interest rates spiralling out of control, economics, government, and business adapted.2 During the 2008 financial crisis, new models and tactics including modern monetary theory and quantitative easing were embraced.3

Now, with climate change affecting our daily lives—with extreme weather events and related air pollution, for example—it is time for new thinking and new models in economics. We must change, but how?

“Doughnut Economics,” with its representation of a safe zone in which economic activity can take place that ensures social equity and respects environmental constraints, may be an answer. The doughnut model is already proving to be a valuable tool for many decision-makers, and it’s one CPAs should have on their radar, particularly given its compatibility with environmental, social, and governance (ESG) principles

Finding the sweet spot

Doughnut Economics is a model first published in 2012 by self-described “renegade economist” Kate Raworth, then a senior researcher with Oxfam and now a senior associate at Oxford University’s Environmental Change Institute.4 Her Oxfam discussion paper “A Safe and Just Space for Humanity: Can We Live Within the Doughnut?” has since been expanded into the book Doughnut Economics: Seven Ways to Think Like a 21st-Century Economist.5

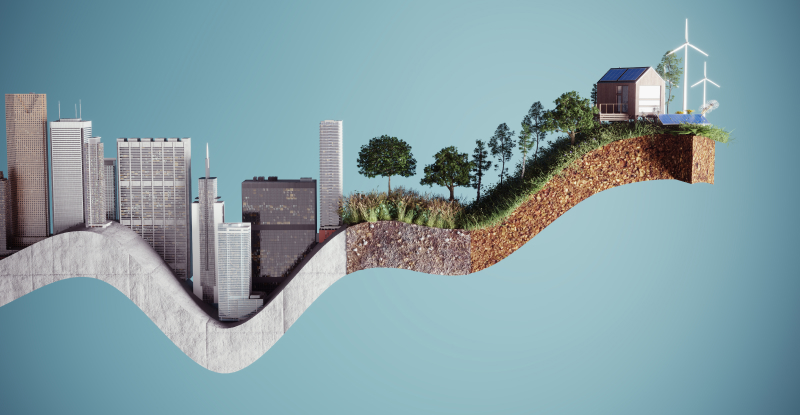

With its two concentric rings (see Figure 1), this aptly named model encourages us to rethink the way traditional economic models have prioritized economic growth at the expense of social and environmental issues. The doughnut model defines a circular ring or “sweet spot” in which economic development can be conducted safely, for the benefit of humankind and the preservation of our natural environment. The “hole” of the doughnut represents an unsafe zone where doing business threatens our social foundation and leads to harmful consequences such as income inequality. The outer ring of the doughnut represents the ecological ceiling: limitations we must place on economic development activities due to the long-term pressure these activities place on our planet’s natural systems.

The doughnut model describes a new way of thinking about economic performance and business development—one that requires corporate citizenship (i.e., supporting community and reducing stress on our planet)—and many economists and policy-makers are embracing it. In 2020, for example, the City of Amsterdam adopted a circular strategy based on the doughnut model6 as a basis for municipal policies, aiming to get citizens “inside the doughnut”7 with a sustainable approach focused on renewable materials. Other local governments are following suit, including the City of Copenhagen, and, closer to home, the City of Nanaimo on Vancouver Island.

It is important to note that some public policy-makers and academics have critiqued the doughnut model for downplaying the development and growth previously thought necessary for the healthy functioning of communities. In response, others have noted that the model suggests these activities are acceptable and even encouraged, as long as they take place within the “ring of the doughnut,” resulting in a more just society, where citizens’ needs are met within the ecological limits of our planet.8

How Doughnut Economics overlaps with ESG

If you’re thinking “this sounds a lot like ESG,” you’re right. The three central factors that make up the ESG proposition (environmental, social, and governance) can be mapped onto the doughnut’s rings (see Figure 1). The inner ring represents the “social foundation”—the life essentials required by each human being.9 Companies can support these needs by, for example, offering fair wages and implementing equity, diversity, and inclusion policies. The outer ring represents environmental limits that must be respected. Governance is required to keep organizations within the bounds of the doughnut, meeting social needs and not overstepping “the planetary boundaries that protect Earth’s life-supporting systems.”10

Slicing into the doughnut

So why should CPAs care about the doughnut model? Let’s focus on one slice—climate change—to explore this question (see Figure 2).

As Kate Raworth describes, “The expected consequences of crossing planetary boundaries [the outer ring of the doughnut] include global temperature rise; loss of polar ice sheets and glacial freshwater supplies; rapid sea-level rise; bleaching and mortality in coral reefs; increases in large floods; abrupt shifts in forest and agricultural systems; potentially challenging the viability of contemporary human societies.”11

British Columbia has already felt some of the impacts of climate change, and the situation will only worsen without intervention.12 As CPAs, we need to be aware of these impacts and do what we can to manage climate change risks and mitigate consequences for our companies, our employees, and our stakeholders. It might be tempting to think “Climate change won’t have a significant impact on my organization,” and you may be right—at first. But are you really going to be immune? Let’s say you work for a small restaurant chain. If climate change brings extreme temperatures, how will you keep the kitchens functioning in a heatwave? What about food? Supply chains and agriculture will be disrupted by extreme weather, which may mean forced menu changes and increased costs.

Drill down a bit further and consider the broader ramifications. Clams and mussels on the menu? A researcher at UBC estimated that the early July 2021 heatwave killed one billion clams, mussels, sea stars, and sea snails.13 Mussels may recover within two years, but clams will take longer. Mollusks are food for birds and part of the marine ecosystem, potentially affecting fish and other creatures of our marine food supply.

This is just one example of many. Service companies make up 81% of BC’s economy by employment,14 and within that sector, retail is the second-largest employer after health care.15 Supply chain disruptions caused by extreme weather will be similar to those experienced during COVID-19.16 Retailers will struggle to maintain revenue targets and use their square footage effectively when inventories temporarily drop during the year.

There’s also the potential impact on individual employees, clients, and customers/consumers as climate change progresses and extreme weather events and supply disruptions become more frequent. If the individuals on which your organization relies are personally affected by floods or fires, what will this do to your productivity and/or your customer base?

On top of all of this, your bank is already discussing climate change and initiatives for all clients, not just large public companies. For example, in July 2021, we saw the launch of Project Carbon, a partnership of four global banks—CIBC (Canada), NatWest Group (Britain), National Australia Bank (Australia), and Itaú Unibanco (Brazil)—that aims to “create a more liquid market for carbon offsets and help clients manage risks associated with climate costs.”17

Staying within the doughnut

Simon Philp, FCPA, FCMA, market vice-president of commercial banking for CIBC, notes that small to medium-sized enterprises across a broad range of industries are implementing green initiatives, driven by owner preferences and employee and customer requests. He recommends that CPAs first identify what climate change or other ESG impacts they want to measure, and then take action through initiatives and investments.

“Looking at competitors and public companies in the same industry will provide some ideas,” says Philp. “Leadership and other stakeholders might support this work because it is the right thing to do, or they may need a ‘business case’ that could include employee engagement, recruitment, sales growth, and/or customer retention.”18

Research tells us that companies who engage in corporate social responsibility, a precursor of ESG, are able to access lower rates of interest on loan facilities than their peers.19 According to a 2020 survey by McKinsey, 57% of executives and investment professionals agree that ESG programs create shareholder value, and seven in 10 take ESG into account in strategic and operational decisions—this includes choosing supply chain partners.20 A 2019 study shows that a strong ESG focus creates value through top-line growth, cost reductions, fewer regulatory and legal interventions, productivity boosts, and better investment and asset optimization.21

By adopting the doughnut model for governance, strategic, and operational decision-making, a company is more likely to make decisions that result in improved ESG metrics, positioning itself for the future of financing with a more holistic approach to business. In turn, this means more resilient local communities, a healthier planet, and a sustainable and profitable business over the long term.

Authors

Mia Maki is an assistant teaching professor and the academic director of undergraduate programs for the Peter B. Gustavson School of Business at the University of Victoria. Active with CPABC’s PD program, Mia is an author and instructor for the Controller’s Operational Skills program, the Strategic Management certificate program, and the Advanced Strategic Management Certificate program.

Douglas Stuart is an assistant teaching professor at the Peter B. Gustavson School of Business at the University of Victoria. As a CPABC faculty ambassador, Douglas advocates for the CPA profession in his daily work with students.

Originally published in the September/October 2021 issue of CPABC in Focus.